Q1 2022 is over and after my birthday month, it feels crazy thinking that I am reaching my 30s soon! I believe and hope that my 30s will be a great time as I would hopefully understand myself more, be able to do better in my career as well as personal life although we never know what will happen in the future. But of course, I will enjoy my last bit of 20s!

March has been a volatile and a roller-coaster month as almost everyone thought the FED would be very aggressive in it’s interest rate hike to fight inflation but on 10 March, we saw SVB faced difficulties and domino’s effects as well as the huge Credit Suisse being bought over by UBS. March 2023 definitely felt like a crypto month but just that banks were the ones making the news. From the aggressiveness of the FED and majority thinking that a 50 bps hike will be done to eventually it being a 25 bps and even before the interest rate hike, Goldman Sachs gave a warning that the FED raising the interest rate further would break the banking industry. There was a scare with Deushce Bank as their shares plunged and people are worried about it as the past 2 weekends we have seen SVB collapse and Credit Suisse get bought out so whether will anything happen on the consecutive 3rd weekend.

We can see that inflation is still the main goal for the FED and they want to bring it down but right now with the risk of banks collapsing and bringing down the whole economy, many have already been saying that the FED will have a rate cut soon but the FED has mentioned that they will still keep rates up to combat inflation but we shall see. In terms of the portfolio, I would say it has recovered quite significantly although I am still in the red for certain counters but overall it is still looking in a better state than end 2022 and early 2023 which was quite bad.

Stocks Portfolio

It does feel finally that the amount I am investing in is building onto the value of the portfolio as stocks (mainly Tesla) and index ETFs gain some however I do think we are still in for a volatile and tough 2023 as the FED is bent on fighting inflation and so even though rate increases is nearing an end with probably rate cuts (?) but it still depends on the data coming in, rates should still remain high as we fight against inflation.

More layoffs are on the way as Meta, Accenture and others show more cuts and also Credit Suisse would most likely also face cuts especially for roles that are similar especially in the investment banking business when UBS takes over it most probably at the end of 2023. Even Endowus is cutting which we can see many companies are cutting costs and the most direct way is to cut manpower. Don’t really know how bad it will get or whether things will stagnate but yea, just DCA-ing in.

Portfolio has gone up in value but not early 2022 levels which was a bull market but I like that I have automate my investments and it really is a hand-offs with more weightage in my monthly DCA to index funds as I build it up.

Crypto Portfolio

After the Luna and FTX incidents, I have pivoted all my crypto funds to BTC and ETH. Losing money was not fun and a pretty substantial amount at that.

Read more: I got liquidated and lost my whole LUNA position | Anchor Borrow

Anyway, crypto saw a little recovery, not a huge portion of my portfolio but it still affects the overall amount so still happy about it. I am currently not really adding positions into crypto except for small amounts. I want to build up a larger base of index ETFs before venturing into the “fun” stuff. So here is my crypto portfolio at the end of Q1.

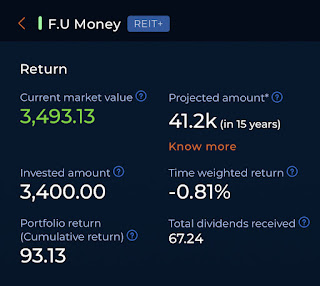

Syfe REIT+ Portfolio

Syfe REIT+ portfolio has been interesting for me as I started DCA-ing into it in September 2022 before all the interest rate hikes and focus on inflation. Over the past few months, it has been volatile but exciting as we see the news and macro environment affecting REITs.

Read more: Q3 2022 Portfolio Updates | 💎 🙌 🐻

The portfolio has grown a little as you can see here mainly due to dividends. I will still continue DCA-ing in monthly as long as I have sufficient cashflow. Hoping to grow this up.

Q1 thoughts and reflections

Not much thoughts to be honest, life has been keeping me busy, I am travelling and work also keeps me busy so with my investments on automation, it does feel like everything is set, I just have to wait for the bull market to come although we do not know when that will be exactly.

I am getting closer to my goal of hoping to reach $100,000 in investments and cash savings although the market is volatile but still looking pretty on track. Job stability is one thing on my mind and other than that, life is good.

Many weddings in the next few months as my friends are starting to settle down with their other half. Happy for them! 2nd half of 2023 will be interesting as we see how the FED navigates the situation and all eyes on the banks as we see if the industry is strong enough to tide through.

Crypto can be seen as a strong contender as people start to realise leaving all their cash in the banks might not be as safe as they think but of course, cryptocurrency is a lot more volatile and risky if you are not sure of what you are buying or how you are storing it. Overall, it’s been a great quarter, onwards to the next!

%20.png)

%20.png)

No comments:

Post a Comment